Balance Sheet

The balance sheet is one of the 3 major financial statements.

It shows company’s:

▪️Assets: What it owns

▪️Liabilities: What it owes

▪️Shareholders Equity: It's net worth attributable to its owners

At a fixed point in time.

That “at a point in time” part is key!.

A balance sheet is a SNAPSHOT of a company’s net worth.

It is usually measured at the end of a quarter/year.

That’s different from an income statement or cash flow statement, both of which are measured over periods of time

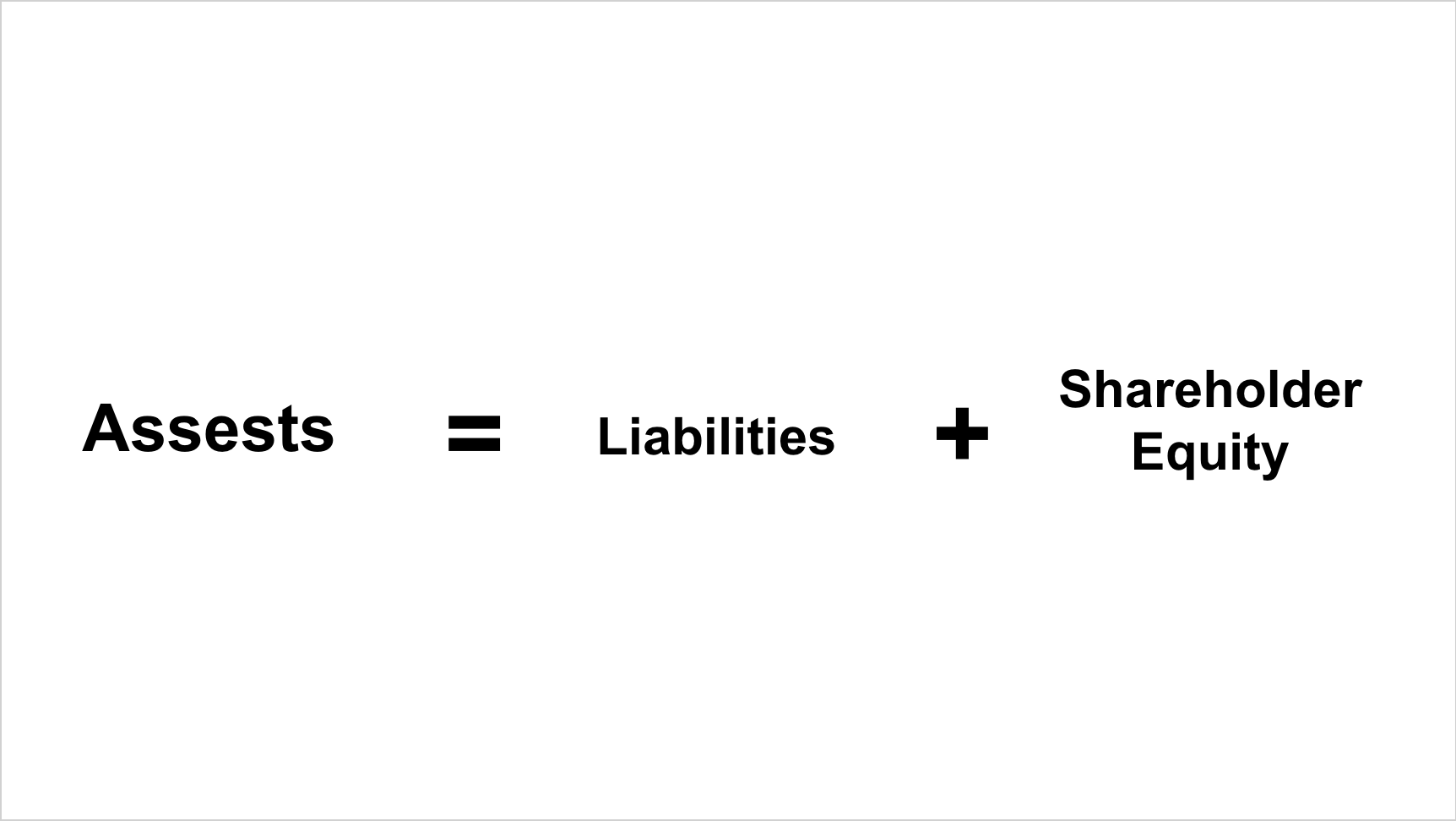

All balance sheets follow the same formula:

Assets = Liabilities + Shareholders Equity

This formula must be in balance at all times

(Hence the term “balance sheet”).

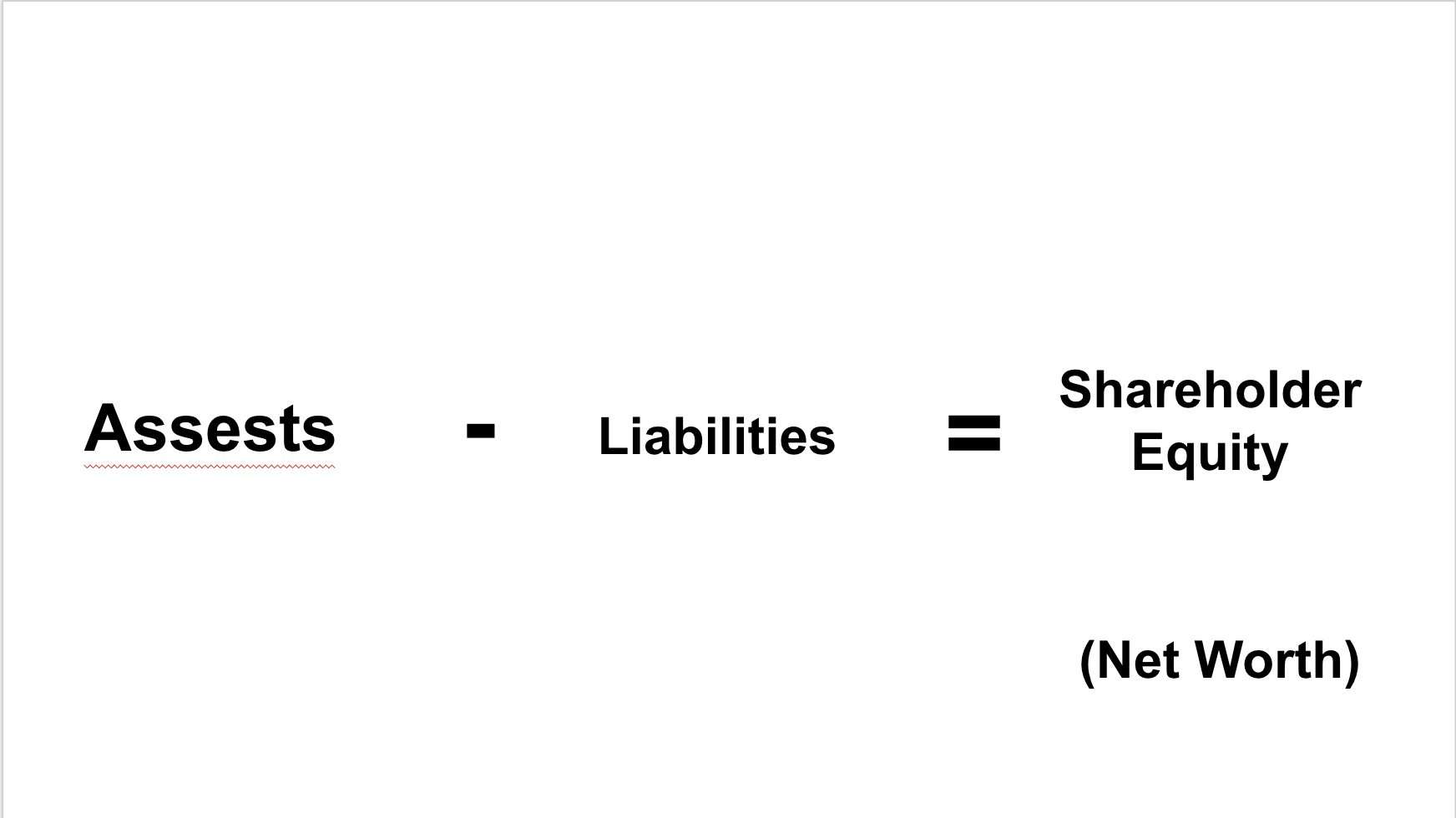

Side Note:

This formula can be easily re-arranged into the “net worth” formula that you are already familiar with

Side Note:

This formula can be easily re-arranged into the “net worth” formula that you are already familiar with

Assets - Liabilities = Shareholders Equity (Net worth)

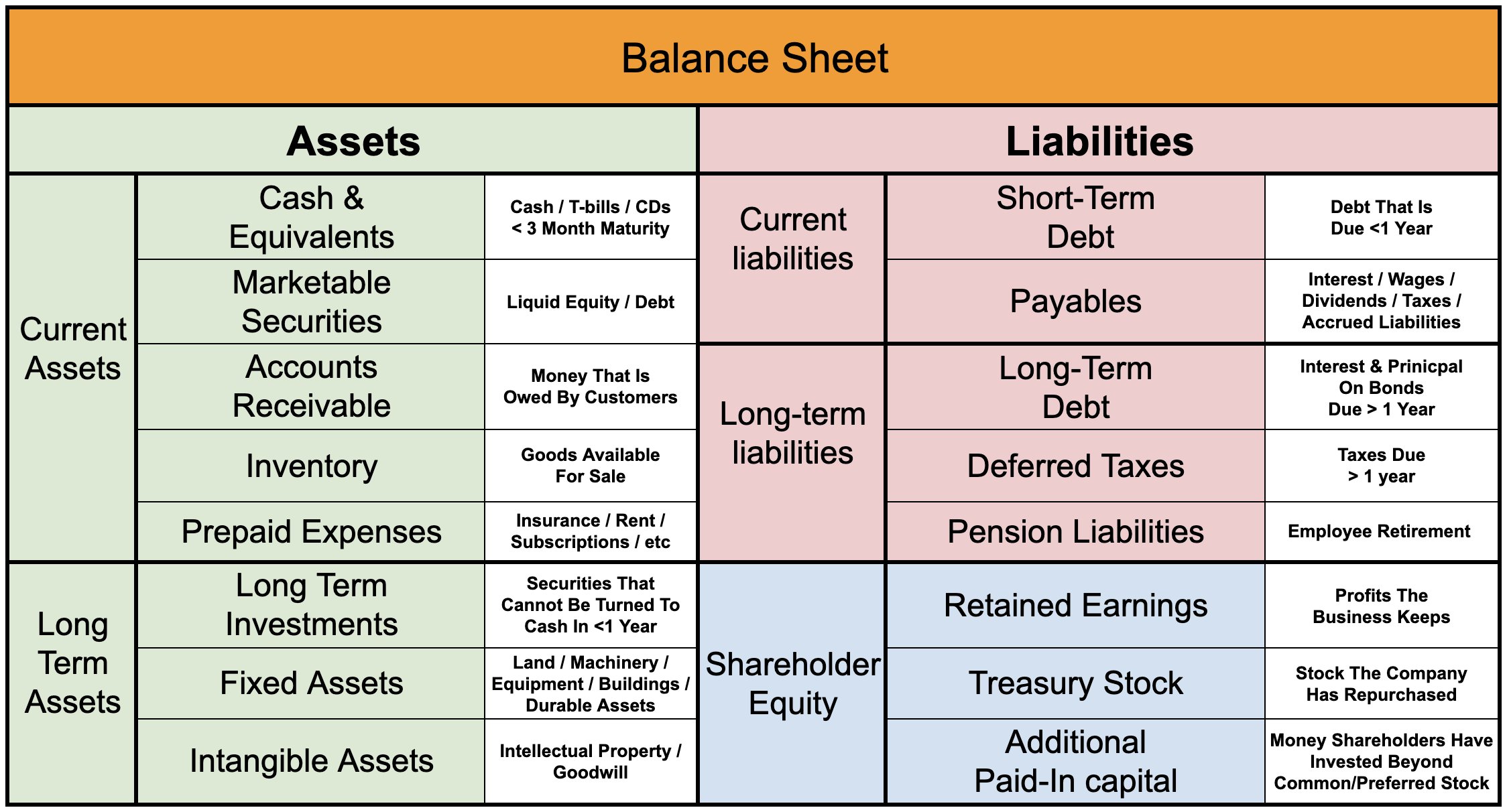

Companies are differed a way in how they categorize each item on their balance sheet

Companies are differed a way in how they categorize each item on their balance sheet

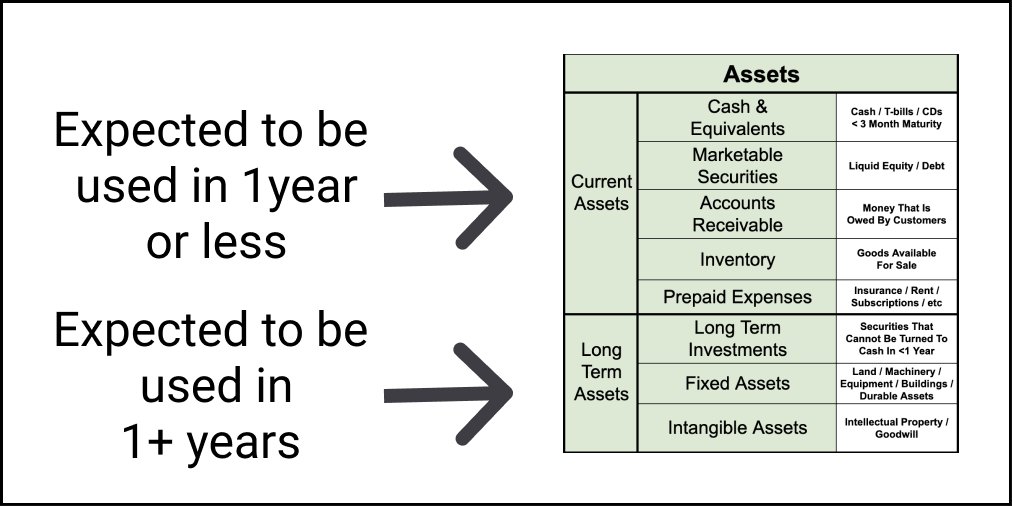

This graphic above shows some of the most commonly used categories & terms.

Let’s start with assets, which is what a company OWNS.

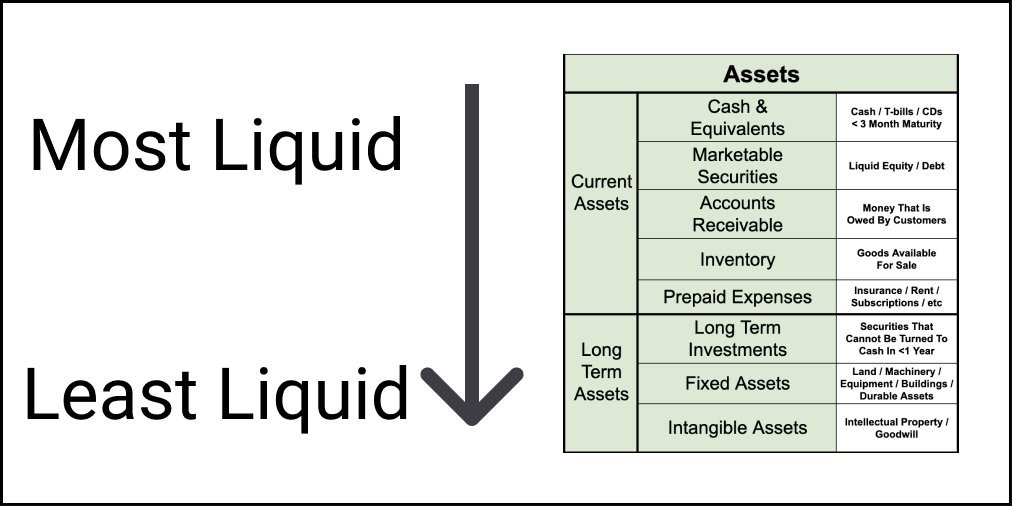

Assets are listed in order of liquidity

This graphic above shows some of the most commonly used categories & terms.

Let’s start with assets, which is what a company OWNS.

Assets are listed in order of liquidity

(Liquidity means how quickly a security can be turned into cash)

In above graphic,the most liquid assets are at the top, the least liquid on the bottom.

(Liquidity means how quickly a security can be turned into cash)

In above graphic,the most liquid assets are at the top, the least liquid on the bottom.

There are two categories of assets:

Current assets:

Assets that are expected to be used in < 1 year

Current assets:

Assets that are expected to be used in < 1 year

Long-term assets:

Assets that a company will benefit from for >1 year

Common current assets:

▪️Cash: Checking account, t-bills, CDs w/ < 3 maturity

▪️Marketable Securities: Stocks, bonds...etc that can easily become cash

▪️Accounts Receivable: Money it is owed by its customers

▪️Inventory: Unsold goods

▪️Prepaid expenses: Insurance, rent, etc…

Long-term assets come in 2 forms:

1: Tangible Assets

▪️Buildings

▪️Equipment

▪️Property

▪️Stores

2: Intangible Assets

▪️Trademarks

▪️Goodwill (premiums paid to make an acquisition)

▪️Patents

▪️Stocks/Bonds held >1 Year

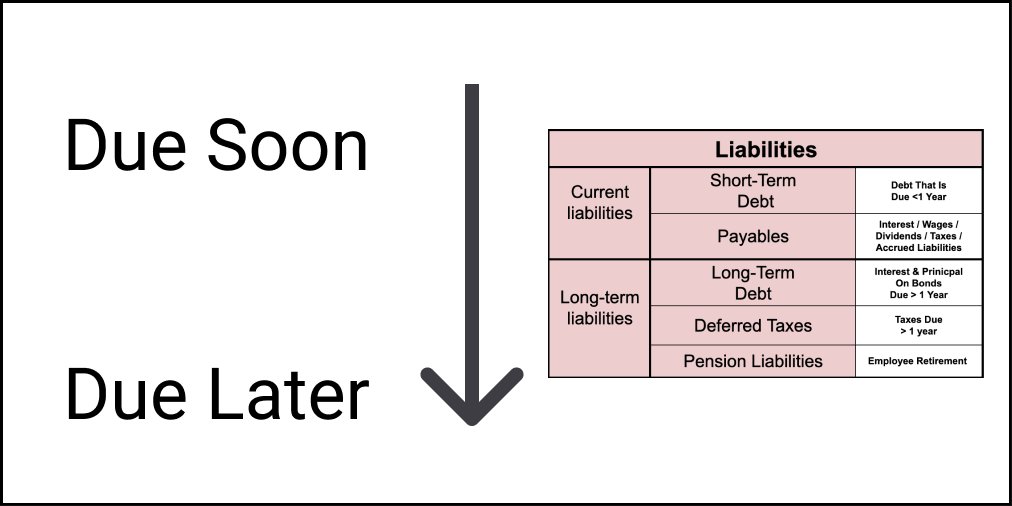

Now for Liabilities, which are what a company OWES .

There are 2 categories of liabilities:

1: Current liabilities:

▪️Bills that will be paid in < 1 year

2: Long-term liabilities:

▪️Bills that are due in >1 year

Common current liabilities (due < 1 year):

▪️Short-term debt

▪️Accounts payable (money owed to suppliers)

▪️Interest

▪️Unpaid Wages

▪️Dividends

▪️Taxes

Common long-term liabilities (due >1 year):

▪️Long-term debt (also called "Notes")

▪️Customer pre-payment

▪️Taxes

▪️Pension

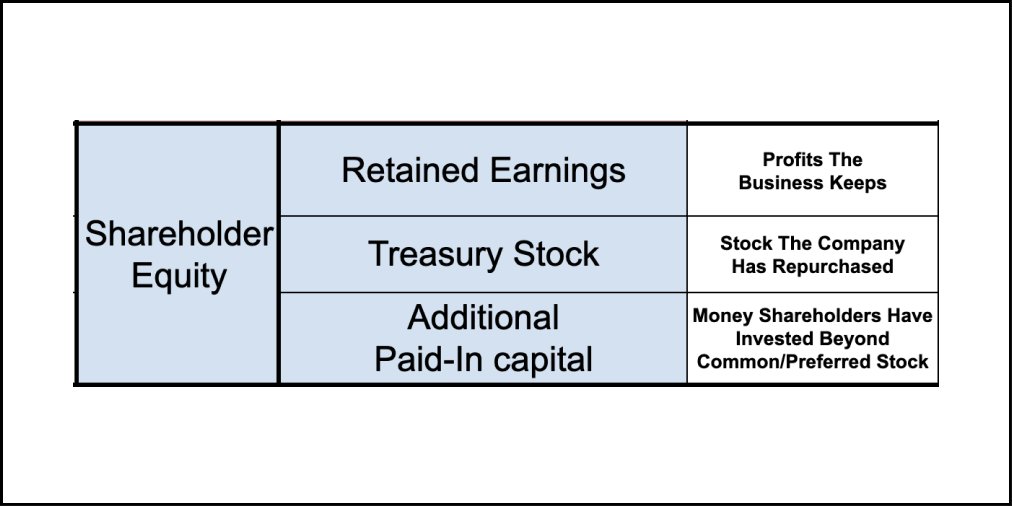

Finally, is shareholders equity

This is money attributable to the business owners (shareholders)

Common categories:

▪️Retained Earnings: Net profits a company reinvests in the business

▪️Treasury Stock: Money used to buy back stock

▪️Additional Paid-In Capital: Amount shareholders have invested beyond common/preferred stock